【译者按】本文不仅说明了美国审计师出具标准无保留意见审计报告所要求具备的五个必要条件,而且指出如果这些必要条件不能满足的话,审计师将会出具与无保留意见相背离的其他类型的审计报告,诸如带说明段的无保留意见审计报告、保留意见审计报告、否定意见审计报告、无法表示意见审计报告。以下内容由CPA财会翻译网翻译并发布,版权所有,未经许可,不得转载。

A standard unqualified auditor's report is issued when the following conditions have been met:

1. All statements---balance sheet, income statement, statement of retained earnings, and statement of cash flows---are included in the financial statements.

2. The three general standards have been followed in all respects on the engagement.

3. Sufficient appropriate evidence has been accumulated, and the auditor has conducted the engagement in a manner that enables him or her to conclude that the three standards of field work have been met.

4. The financial statements are presented in accordance with U.S. generally accepted accounting principles. This also means that adequate disclosures have been included in the footnotes and other parts of the financial statements.

5. There are no circumstances requiring the addition of an explanatory paragraph or modification of the wording of the report.

只有在满足以下条件时,才可出具标准无保留意见审计报告:

1、所有报表——资产负债表、利润表、留存收益表和现金流量表——都包含在财务报表之中。

2、在审计约定的所有方面遵循了美国公认审计准则中的三条一般准则(见附表2-3)。

3、已收集了充分、适当的审计证据,而且审计师也履行了审计约定,使之得出符合美国公认审计准则中的三条现场工作准则的结论(见附表2-3)。

1、所有报表——资产负债表、利润表、留存收益表和现金流量表——都包含在财务报表之中。

2、在审计约定的所有方面遵循了美国公认审计准则中的三条一般准则(见附表2-3)。

3、已收集了充分、适当的审计证据,而且审计师也履行了审计约定,使之得出符合美国公认审计准则中的三条现场工作准则的结论(见附表2-3)。

4、财务报表按照美国公认会计准则列报,这也意味着在财务报表附注及其他部分中得以充分的披露。

5、无需再增加审计报告的说明段或措词的修改。

5、无需再增加审计报告的说明段或措词的修改。

When these conditions are met, the standard unqualified audit report, as shown in Figure 3-1, is issued. The standard unqualified audit report is sometimes called a clean opinion because there are no circumstances requiring a qualification or modification of the auditor’s opinion. The standard unqualified report is the most common audit opinion. Sometimes circumstances beyond the client’s or auditor’s control prevent the issuance of a clean opinion. However, in most cases, companies make the appropriate changes to their accounting records to avoid a qualification or modification by the auditor.

当上述条件得以满足时,审计师将出具标准无保留意见审计报告(见图3-1)。标准无保留意见审计报告有时被称为“无保留意见”,因为在任何情况下都不需要对审计意见进行限定或修改。 标准无保留意见是最常见的一种审计意见。有时候,客户或审计师遇到无法控制的情况会阻止发表无保留意见。但是,在大多数情况下,公司会对其会计记录做出适当的调整,以避免审计师发表保留或修改意见。

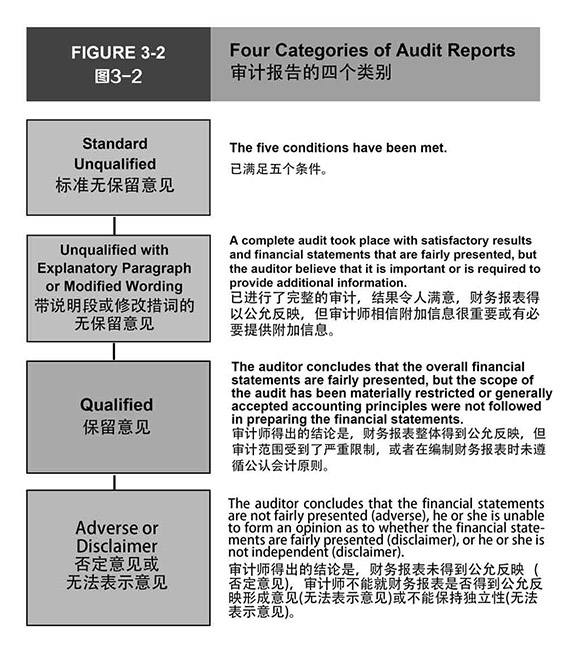

If any of the five requirements for the standard unqualified audit report are not met, the standard unqualified report cannot be issued. Figure 3-2 indicates that categories of audit reports that can be issued by the auditor. The departures from a standard unqualified report are considered increasingly severe as one moves down the figure. Financial statement users are normally much more concerned about a disclaimer or adverse opinion than an unqualified report with an explanatory paragraph.

若不符合上述标准无保留意见审计报告的全部五个要求,则不能出具标准无保留意见报告。 图3-2显示可以由审计师出具的审计报告类别。如图所示,越往下移动,就会与标准无保留意见偏离得越严重。与带说明段的无保留意见相比,财务报表使用者通常更关注无法表示意见或否定意见。

TABLE 2-3 Generally Accepted Auditing Standards

附表2-3 美国公认审计准则

General Standards

- 1. The audit must be performed by a person or persons having adequate technical training and proficiency as an auditor.

- 2. The auditor must maintain independence in mental attitude in all matters relating to the audit.

- 3. The auditor must exercise due professional care in the performance of the audit and the preparation of the report.

一般准则

- 1、审计工作必须由一名或多名训练有素且技术娴熟的审计师来执行;

- 2、审计师应在思想态度上对所有与审计相关的事项保持独立性;

- 3、审计师在执行审计工作和编制报告的过程中必须尽心尽职。

Standards of Field Work

- The auditor must adequately plan the work and must properly supervise any assistants.

- The auditor must obtain a sufficient understanding of the entity and its environment, including its internal control, to assess the risk of material misstatement of the financial statements whether due to error or fraud, and to design the nature, timing, and extent of further auditing procedures.

- The auditor must obtain sufficient appropriate audit evidence by performing audit procedures to afford a reasonable basis for an opinion regarding the financial statements under audit.

现场工作准则

- 1、审计师应制订充分的工作计划,并对助理的现场工作给予适当的监督;

- 2、审计师应充分地了解实体(被审计单位)及其环境,包括其内部控制,以评估是否存在因舞弊或错误导致财务报表发生重大错报的风险,并设计下一步审计程序的性质、时点和范围程度;

- 3、审计师必须通过执行审计程序获得足够、充分的审计证据,以便能够对被审计的财务报表发表审计意见获得合理的依据。

Standards of Reporting

- 1. The auditor must state in the auditor’ report whether the financial statements are presented in accordance with generally accepted accounting principles (GAAP).

- 2. The auditor must identify in the auditor’s report those circumstances in which such principles have not been consistently observed in the current period in relation to the preceding period.

- 3. When the auditor determines that informative disclosures are not reasonably adequate, the auditor must so state in the auditor’s report.

- 4. The auditor must either express an opinion regarding the financial statements, taken as a whole, or state that an opinion cannot be expressed, in the auditor’s report. When the auditor cannot express an overall opinion, the auditor should state the reasons therefor [sic] in the auditor’s report. In all cases where an auditor’s name is associated with financial statements, the auditor should clearly indicate the character of the auditor’s work, if any, and the degree of responsibility the auditor is taking, in the auditor’s report.

报告准则

- 1、审计师必须在审计报告中说明财务报表是否按照美国公认会计原则(GAAP)列报;

- 2、审计师必须在审计报告中识别本期与上期相比有哪些不符合公认会计原则的情况;

- 3、当审计师确定信息披露不合理充分时,审计师必须在审计报告中说明这一情况;

- 4、审计师必须在审计报告中对财务报表整体发表意见或声明不能发表意见。当审计师不能发表总体意见时,审计师应在审计报告中说明理由。当审计师的姓名与财务报表相关联时,审计师应在审计报告中明确地指出审计工作的性质(如果有)以及审计师应承担的责任范围。