【注】以下美国标准无保留意见审计报告的基本构成要素由CPA财会翻译网/上海汇英企业管理咨询有限公司翻译并提供,版权所有,未经许可,不得转载!

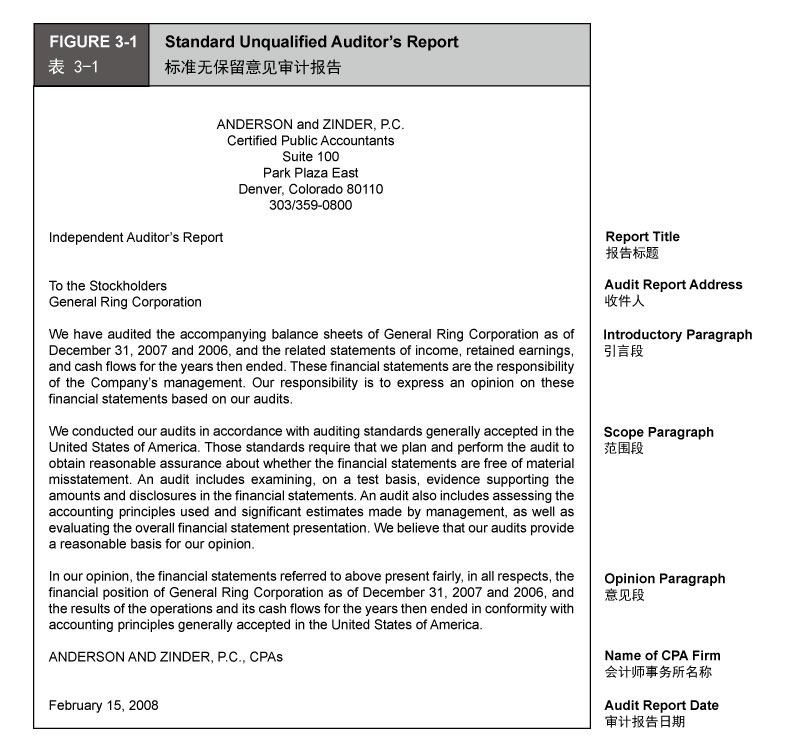

To allow users to understand audit report, AICPA professional standards provide uniform wording for the auditor’s report, as illustrated in the auditor’s standard unqualified audit report in Figure 3-1. Different auditors may alter the wording or presentation slightly, but the meaning will be the same.

为了让财务报表使用者能够理解审计报告,美国注册会计师协会(AICPA)执业准则为审计报告提供了统一的措辞,如图3-1中的标准无保留意见审计报告所示。 不同的审计师可能会对这些措辞或表述稍加改动,但其含义不变。

The auditor’s standard unqualified audit contains seven distinct parts, and these are labeled in bold letters in the margin beside Figure 3-1.

标准无保留意见审计报告包含七个不同的部分,这几个部分已在图3-1旁边的空白处以粗体字标注。

1. Report title. Auditing standards require that the report be titled and that the title include the word independent. For example, appropriate titles include “independent auditor’s report,” “report of independent auditor,” or “independent accountant’s opinion.” The requirement that the title include the word independent conveys to users that the audit was unbiased in all aspects.

1、报告标题:审计准则要求审计报告应有标题,而且标题中应包含“独立”一词。 恰当的标题诸如“独立审计报告”、“独立审计师报告”或“独立会计师审计意见”。 要求在标题中包含“独立”一词,其用意是向财务报表使用者传达该审计在所有方面均无偏见。

2. Audit report address: The report is usually addressed to the company, its stockholders, or the board of directors. In recent years, it has become customary to address the report to the board of directors and stockholders to indicate that the auditor is independent of the company.

2、审计报告的收件人:审计报告通常会被提交给(被审计单位)公司、公司股东或董事会”。 近年来,习惯于将审计报告提交给董事会和股东会,以表明审计师独立于该公司。

3. Introductory paragraph.The first paragraph of the report does three things: First, it makes the simple statement that the CPA firm has done an audit. This is intended to distinguish the report from a compilation or review report. The scope paragraph (see part 4) clarifies what is meant by an audit.

3、引言段:审计报告第一段做了三件事:第一,简要说明了会计师事务所已经进行了审计,其目的是要将该审计报告与汇编报告或审阅报告区分开来。范围段(见第4部分)阐明了审计的含义。

Second, it lists the financial statements that were audited, including the balance sheet dates and the accounting periods for the income statement and statement of cash flows. The wording of the financial statements in the report should be identical to those used by management on the financial statements. Notice that the report in Figure 3-1 is on comparative financial statements. Therefore, a report on both years’ statements is needed.

第二,它列出了已审计的财务报表,包括资产负债表日期、利润表和现金流量表的会计期间。 报告中财务报表的措词应与管理层在财务报表中使用的措词一致。 请注意,图3-1中的报告是针对比较财务报表的。因此,需要出具一份有关两个年度财务报表的审计报告。

Third, the introductory paragraph states that the statements are the responsibility of management and that the auditor’s responsibility is to express an opinion on the statements based on an audit. The purpose of these statements is to communicate that management is responsible for selecting the appropriate generally accepted accounting principles and making the measurement decisions and disclosures in applying those principles and to clarify the respective roles of management and the auditor.

第三,引言段指出财务报表由管理层负责,而审计师的责任是在审计的基础上对财务报表发表意见。这些财务报表的目的是要表明管理层负责选择适当的公认会计原则,并在应用这些原则过程中做出计量决策和披露,同时明确了管理层和审计师各自的作用。

4. Scope paragraph. The scope paragraph is a factual statement about what the auditor did in the audit. This paragraph first states that the auditor followed U.S. generally accepted auditing standards. For an audit of a public company, the paragraph will indicate that the auditor followed standards of the Public Company Accounting Oversight Board. Because financial statements prepared in accordance with U.S. accounting principles and audited in accordance with U.S. auditing standards are available throughout the world on the Internet, the country of origin of the accounting principles used in preparing the financial statements and auditing standards followed by the auditor are identified in the audit report.

4、范围段:范围段对审计师在审计过程中所做的工作进行了事实陈述。本段首先指出审计师遵循了美国公认的审计准则。针对上市公司的审计,该段还将表明审计师遵循了上市公司会计监督委员会的准则。由于按照美国会计原则编制并根据美国审计准则审计的财务报表可以在世界各地从互联网上获取,所以在审计报告中一定要注明在编制财务报表时所采用的会计原则和审计师所遵循的审计准则的来源国。

The scope paragraph states that the audit is designed to obtain reasonable assurance about whether the statements are free of material misstatement. The inclusion of the word material conveys that auditors are responsible only to search for significant misstatements, not minor misstatements that do not affect users’ decisions. The use of the term reasonable assurance is intended to indicate that an audit cannot be expected to completely eliminate the possibility that a material misstatement will exist in the financial statements. In other words, an audit provides a high level of assurance, but it is not a guarantee.

范围段说明审计的目的是要对财务报表是否不存在重大错报获取合理保证。“重大”这一词所传达的含义是审计师仅负责查找重大的错报,而不是那些不会对财务报表使用者的决策造成影响的小错报。使用“合理保证”这一术语的用意是指,不能期望审计可以完全消除财务报表中存在重大错报的可能性。换句话说,审计提供了一种高水平的保证,但它并不是担保。

The remainder of the scope paragraph discusses the audit evidence accumulated and states that the auditor believes that the evidence accumulated was appropriate for the circumstances to express the opinion presented. The word test basis indicate that sampling was used rather than an audit of every transaction and amount on the statements. Whereas the introductory paragraph of the report states that management is responsible for the preparation and content of the financial statements, the scope paragraph states that the auditor evaluates the appropriateness of those accounting principles, estimates, and financial statement disclosures and presentations given.

范围段余下的部分讨论了所收集的审计证据,并指出审计师相信当前为发表审计意见所收集的证据是适当的。“在测试的基础上”这一措词表示审计采取抽样的方式进行,而不是要审查财务报表中所有的交易和金额。审计报告的引言段说明管理层负责财务报表的编制和内容,而范围段则说明审计师要评估这些会计原则、会计估计以及财务报表的披露和列报的适当性。

5. Opinion paragraph. The final paragraph in the standard report states the auditor’s conclusions based on the results of the audit. This part of the report is so important that often the entire audit report is referred to simply as the auditor’s opinion. The opinion paragraph is stated as an opinion rather than as a statement of absolute fact or a guarantee. The intent is to indicate that the conclusions are based on professional judgement. The phrase in our opinion indicates that there may be some information risk associated with the financial statements, even though the statements have been audited.

5、意见段:标准审计报告的最后一段说明了审计师根据审计结果得出的结论。报告的这一部分内容是如此重要,以至于整个审计报告通常被简称为“审计师的意见”。意见段表达的是一种意见,并不是一种绝对事实的陈述或担保,其目的是要表明该结论是基于职业判断得出的。“我们认为”这一短语表示,即使财务报表已经过审计,仍有可能存在与财务报表相关的一些信息风险。

The opinion paragraph is directly related to the first and fourth generally accepted auditing reporting standards. The auditor is required to state an opinion about the financial statements taken as a whole, including a conclusion about whether the company followed U.S. generally accepted accounting principles.

意见段与美国公认审计报告准则第一条和第四条直接相关。审计师必须对财务报表整体发表意见,包括对该公司(被审计单位)是否遵循了美国公认会计原则得出结论。

One of the controversial parts of the auditor’s report is the meaning of the term present fairly. Does this mean that if generally accepted accounting principles are followed, the financial statements are presented fairly, or something more? Occasionally, the courts have concluded that auditors are responsible for looking beyond generally accepted accounting principles to determine whether users might be misled, even if those principles are followed. Most auditors believe that financial statements are “presented fairly” when the statements are in accordance with generally accepted accounting principles, but that it is also necessary to examine the substance of transactions and balances for possible misinformation.

审计报告中有一个争议的地方就是“公允列报”这一用词的含义。 这是否意味着如果遵循了公认会计原则,那么财务报表算是公允列报了吗?还是有更多的含义? 有些情况下,法院已作出判定认为,即使遵循了这些公认会计原则,审计师也有责任超越公认会计原则来确定财务报表使用者是否有可能被误导。大多数审计师相信,当财务报表符合公认会计原则时,财务报表就是被“公允列报”了,但是审计师也有必要检查交易和余额的实际情况,以防可能发生的信息错报。

6. Name of CPA firm. The name identifies the CPA firm or practitioner who performed the audit. Typically, the firm’s name is used because the entire CPA firm has the legal and professional responsibility to ensure that the quality of the audit meets professional standards.

6、 注册会计师事务所的名称:该名称可以辨别执行本次审计工作的注册会计师事务所或审计从业人员。 特别是,使用事务所的名称是因为整个会计师事务所具有承担法律和执业的责任,以确保审计的质量符合执业准则。

7. Audit report date. The appropriate date for the report is the one on which the auditor completed the auditing procedures in the field. This date is important to users because it indicates the last day of the auditor’s responsibility for the review of significant events that occurred after the date of the financial statements. In the audit report in Figure 3-1, the balance sheet is dated December 31, 2007, and the audit report is dated February 15, 2008. This indicates that the auditor has searched for material unrecorded transactions and events that occurred up to February 15, 2008.

7、审计报告日期:审计报告的适当日期就是审计师完成现场审计程序的日期。 这个日期对财务报表使用者来说很重要,因为它代表着审计师负责对财务报表日之后所发生的重大事件进行审核的最后一天。在图3-1所示的审计报告中,资产负债表的日期为2007年12月31日,而审计报告的日期为2008年2月15日。这表明审计师已经查询了截止至2月15日所发生的重大未记录的交易和事项。